Risky Business

To prosper during the Great Recession, Canadian Business got a major makeover. New editor Steve Maich thinks he has the winning formula, but do the numbers support his optimism?

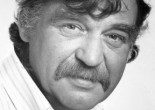

Canadian Business editor-in-chief Steve Maich sits at a two-seater table at a Timothy’s coffee shop in late October 2009, a short walk from Rogers command central, the hulking mass at the north end of downtown Toronto. He strikes what I can only assume is his signature pose, the same one he has in the portrait accompanying his editor’s letter. Here, as there, he appears relaxed, arms at his side, one leg crossed over the other, his face displaying the same confident grin of a man who believes he’s in control. Today, though, he doesn’t have to mirror Bay Street’s basic suit, shirt and tie. Instead, he’s dressed down in a navy pullover, sleeves casually rolled, plus jeans and hiking boots.

Just over three months have passed since Maich took charge of the now 82-year-old magazine and just weeks since the newly redesigned mid-October issue hit newsstands across the country.On its cover: a scowling Frank Stronach, founder of Magna International Inc., the mammoth auto-parts supplier. The coverline: “Frank Stronach Bets the Company.” Clearly, Maich is making good on the promise in the relaunch issue, which stated that CB will follow the “glamour and adventure of modern business.”

He begins our conversation by saying that the magazine’s aim is to be as “authoritative, engaging and interesting” as possible while being “insightful and entertaining.” Though his words sound like promotional copy, there’s no doubt about his passion for business journalism and his confidence in his ability to lace the magazine’s pages with that enthusiasm. “We’ve changed the look, certain things about our approach, but I don’t think the mandate has changed,” he says. The goal: to get readers “caught up in the drama, excitement and stakes of business.” Maich’s head nods in agreement with himself. “Business is inherently interesting because you’ve got these big companies driven by people with big egos and big ideas with formidable talents who are out there competing with one another—the stakes are huge,” he adds. His words drip with genuine elation and fascination. As a gambler might explain the draw of his game, he says, “The conflict is where the drama lives and dies.”

Maich has certainly seen his share of conflict and drama over the past few months. Following the involuntary departure of CB’s former publisher and art director and the shunting aside of his predecessor, Joe Chidley (who’s since left the company), Maich found himself holding the knife in yet another magazine bloodletting: two editors and four writers departed, among other staffers, and fact-checking was scaled back. Maich calls carrying out the layoffs “the worst thing in this business.” He then restocked CB’s masthead with a new managing editor from Financial Post Magazine, plus some colleagues from Maclean’s, where he’d been a business columnist for a year before serving as senior editor of the business section for three years. (He still remains executive editor at the newsweekly.) There were whispers in the industry that he was merely a puppet whose strings were held by the hands of Ken Whyte, though it may just be that Maich’s vision mirrors Whyte’s.

However, the events at CB weren’t without precedent. After leaving the National Post, the daily he helped found, Whyte had become publisher and editor-in-chief of Rogers-owned Maclean’s in 2005 and, as of June 2009, taken on additional responsibilities as publisher of CB, Profit and MoneySense before tacking on publishing duties at Chatelaine last October. Following each expansion of his portfolio, Whyte’s modus operandi involved substantial changes of editorial staff, including the delisting of senior people at each title.

All of this unfolded in a climate in which magazine and advertising sales had been plummeting at most titles and, more significantly, the publishing industry, like most businesses and individuals, was trying to reinvent itself in the midst of the Great Recession, the extent of which few, including wide swaths of business journalists and their employers, saw coming. And the chief villains? Jeff Madrick, editor of the scholarly economics magazine Challenge and former New York Times columnist, says, “If I’m going to blame journalism, I’m going to pin it more on the editors.”

As I watch Maich sip his tea, I wonder if he’s one of the editors to whom Madrick was referring. But right now all Maich is talking about is the new CB, that the key to its future growth and prosperity is to “be very current and reactive and analytical of things that are going on in the conversation right now,” and that business is everywhere: “If you have a bank account, if you go to the mall and shop, you’re engaged in business. CB needs to speak to people as workers, as bosses, as owners, as investors. I want to do it all and strike a balance between all of them.”

Yet nowhere over the course of this interview, nor in the first several editor’s columns, does Maich discuss the current miserable economic times.

* * *

It was Ken Whyte who made the decision to change direction and leadership at CB. Though he declined to be interviewed for this article, it’s clear that his actions were based on his perception of the magazine’s flaws under Chidley, who had been CB editor for nine years. One of those flaws, however, was not profitability.

In fall 2007, CB had gone through a major relaunch amid dwindling subscription sales—a June Audit Bureau of Circulations (ABC) report noted more than 5,000 fewer subscriptions than the previous year. Chidley’s redesign ushered in a wave of aspirational theme packages often doused in investment. The first several issues of 2008 repeatedly touted investment stories, including an investment “survival guide,” and articles on “where to invest,” “how to stop worrying,” “where to invest in real estate” and “winning strategies for your beaten-down portfolio.” Masthead Online publisher Doug Bennet feels the magazine overdid the investment focus and lacked broader business coverage.

But advertisers embraced the revised CB; ad sales jumped, with revenue increasing by nearly $1 million from 2007 to 2008. The editorial packages even received two honourable mentions at the 2008 National Magazine Awards, and the next year CB was shortlisted for Magazine of the Year.

At Timothy’s, Maich was diplomatic in discussing his predecessor’s magazine, maintaining that Chidley “did a good job and put together a really good team of good journalists” (a handful of whom he retained) and choosing to herald the “position of strength” he is now building on. He sidestepped any criticism of his predecessor except to say, “There were a couple of areas where we looked at it and thought we could do better, like newsstand sales.”

It’s true that newsstand sales plunged nearly 40 percent between 2007 and 2008. On the other hand, most major North American business magazines had undergone significant losses during that time. Aside from the obvious impact of the recession, CB also experienced a dramatic drop of so-called sponsored sales of single copies: multiple issues purchased by companies for promotional purposes. At the end of 2007, these had averaged nearly 18,000 per issue, but a year later the number was down 83 percent. A $1 cover-price increase after the relaunch also likely had an impact. However, thanks to the solid ad revenue, Masthead’s 2009 Top 50 report indicated CB’s total estimated revenue for 2008 was $11.4 million, up roughly two percent from the year before. As unimpressive as these results may seem, competitor Report on Business magazine’s revenue declined almost eight percent in the same period, to $7.7 million. For that matter, Maclean’s didn’t do too well, either, showing a decrease of close to six percent from the previous year, and a near eight percent drop from five years earlier.

Though Canadians have been relatively sheltered from the U.S.-style repercussions of the burst financial bubble, hardship still followed here, though in the early days CB didn’t give it much coverage—or predict how bad it might get. When it did, the attention was not always prominent. Shortly into 2008, Chidley acknowledged in an editor’s note that Canada would be hard hit by a U.S. economic slowdown. But in the summer, he blithely predicted, “I think the U.S. recession will not be as severe or last as long as the doom-and-gloomers predict.” Still, he did go on to say, “On the other hand, I suspect the U.S. recession will have a longer and more severe impact on Canada than most Canadians think.” Maich, still at Maclean’s, wasn’t very prescient either, though he did acknowledge the growing turmoil in the occasional article, such as his August 27, 2008, piece where he highlighted the growing concerns of economic commentator Nouriel Roubini, an early prophet of the collapse.

Closer to the mark were CB’s online columnists. In December 2007, with markets still apparently strong, staff writer Jeff Sanford, who was dismissed after Maich arrived, predicted that 2008 would batter the markets and financial services. “Remember all those credit card offers you got in the mail over the last decade?” he wrote. “All of that easy lending will have to unwind to some degree.” Sanford advised his readers to proceed in 2008 “with caution.” The following March, he announced that the impending crisis was inevitable, stating, “The question now is whether the recession will be shallow and short or long and deep.”

On April 24, 2008, columnist Larry MacDonald posted an online column titled “Recession Watch.” He listed five economic indicators to monitor in order to determine where the economy was at and where it might be headed, though he didn’t venture a guess. By fall, when even the most bullish began to recognize the punishing economic state, Sanford warned we were “heading into another down leg of this grizzly bear of a market.” And at Maclean’s? Recession coverage remained sporadic until early 2009, when Maich and a few colleagues began keeping tabs on the unfolding chaos in a weekly online column entitled “Econowatch.”

As the financial train wreck was being tracked online, CB itself provided the requisite “survival guide” and suggestions on “how to deal,” and even ascribed blame (big business greed and congressional indiscretion). The April 14, 2008, coverline echoed the North American sentiment: “Is It 1929 All Over Again?” Yet CB’s overall examination wasn’t nearly as frequent or critical as its online-only content.

* * *

In what manynow call Recession 2.0, a great debate took place about whether business journalists did a good job of informing citizens of the coming catastrophe. Dean Starkman, managing editor of the Columbia Journalism Review’s business press section, The Audit, believes coverage “was essentially a failure,” namely, that it failed in its “massively important role to make sure people have a grasp of what’s going on in the system that affects them profoundly.”

Starkman says the U.S. press “didn’t do the fundamental reporting, keeping tabs on major financial institutions. No one’s asking anyone to be clairvoyant, all we’re saying is—and the failure of the U.S. media was acute here—report on what’s happening now.” Starkman notes it’s the responsibility of the international business press to keep an eye on the U.S., but particularly for Canada. “What happens in Washington probably has a lot more to do with the way the Canadian economy is going to go than even what happens in Ottawa,” he says.

Madrick is of a similar mind: “What happens to us deeply affects Canada as well, and that’s all the more reason Canadian business journalism should have a responsibility to look into the facts and not go with the flow of conventionalism.”

American Journalism Review senior contributing writer Charles Layton described that conventionalism as “a cacophony of naive reportage.” Madrick’s prescription for avoiding this problem is simple, if hardly inevitable: “There should be an active culture in favour of going against the grain.”

* * *

In the tightly packedbusiness section of a suburban Chapters newsstand, sandwiched between the bold yellow covers of the Harvard Business Review and Strategy and Business magazines, are two CBs, the December 7, 2009, issue, featuring The Rich 100 List (an 11-year CB staple), and the newly conceived Winners & Losers special edition, a pass or fail business report card examining the people and companies that floated to the top or sunk to the bottom in 2009. These CB issues look nothing like the sparse covers of their competitors, though all the other CBs since the Maich relaunch have. Rather than a splash of text over a primary-colour background, the two CBs broadcast a barrage of faces, a who’s who of business. Glancing around, I notice they look conspicuously like the celebrity gossip mags racked nearby. They also look like Whyte’s Maclean’s. The CBs haven’t moved all afternoon, but neither has any other book, save for a lone issue of Fortune.

When I said to Maich at Timothy’s that CB’s new look reminded me of Maclean’s, he thumbed through his first issue, nodded slowly and raised his eyebrows. I got the impression the notion hadn’t occurred to him, or if it had, it had failed to register. (Presumably art director Christine Dewairy, who designs both titles, as well as Profit and MoneySense, is aware of the similarity.) “We managed at Maclean’s to go in and take a different approach to our covers that actually showed pretty substantial improvement in newsstand sales. One of the things we thought is that we could take some of the lessons learned from Maclean’s and apply them to CB’s cover and CB’s look and hopefully drive higher newsstand sales,” said Maich.

It’s a fact that the Whyte-regime Maclean’s has seen an increase in single-copy numbers, but what Maich fails to note is that there was considerable room for growth. In 2005, ABC recorded an average per-issue sale of 7,100 (by comparison, Loulou, “Canada’s shopping expert,” was moving more than three times that number). The most recent figure, for the last half of 2009, was a more respectable—but hardly blue chip—11,500. Overall, the retooled Maclean’s circulation has drifted downward in recent years: the Print Measurement Bureau shows a decline from 394,000 in 2006’s report to 380,000 in 2009’s.

The succession of CB post-redesign covers has followed Whyte’s trademark approach of favouring grabby, newsy content. Thinner and elongated, the all-caps new logo—rather grandiosely divided by an icon of the Rogers building stamped with “Since 1928”—conveys a more professional, highbrow tone than the former title, rendered in a chunky serif font and consuming twice the space. Save for the two gossip-rag issues, the revamped covers are less cluttered than earlier CB incarnations, often proffering answers like “How Google Really Does It” and “Why You’ll Buy Anything from Steve Jobs.” It’s too early to tell what the core 40-plus business audience will make of this approach in the long term; so far, it would seem not much: single-copy sales of the five 2009 issues after the Stronach cover have ranged from 2,100 (November 23: Reinvention of The Bay) to 9,600 (December 7: The Rich 100) and averaged 5,100, a little less than what the magazine was doing under Chidley in 2006, before the crash. Still, David Olive, Toronto Star business columnist, points out CB needs to distinguish itself in an environment far more competitive than in the 1980s, when he worked at the magazine.

CB’s content has also been renovated. The feature well, averaging five pieces from multiple markets across the globe, is now labelled by theme, allowing readers to skim tags like economics, technology, finance, world trade or justice for their arenas of interest. It’s convenient and effective.

Here, too, the design has changed. The newsier and denser format looks surprisingly cleaner than prior versions, even while decreasing white space. Perhaps the most beneficial alteration is the slight departure from investment focus. “Small investors are a very important part of our readership, so we won’t abandon them, but I want a larger tent,” says Maich.

A noticeable aspect of this broadening scope is increased coverage of female business issues: at present women make up just a third of CB’s audience. Pieces on an all-female executive team, investment firms for women run by women and a comparison of female fashion and economic trends have all found a place in the new CB. This past winter’s Winners & Losers special edition hails women as one of the year’s big winners, claiming that as many lost their jobs, Canadian female employment rates hardly changed.

Another addition to the front of book is opinion columns. Conrad Black wrote one, a November 23, 2009, defence of Research In Motion co-CEO Jim Balsillie. One reader wrote about the “bad aftertaste” he experienced; another declared he was “cancelling my subscription, effective immediately.” Maich respects those who disagreed with his decision to allow his former boss at National Post to file his opinion from a prison cell, but notes, “We should want as many good, provocative voices in the magazine as we can get. It’s as simple as that.”

* * *

Three months afterour first meeting, Maich is back at Timothy’s, his attire as casual as before. The notable change is in his confident enthusiasm, which has risen from its already heightened state in October. “It’s really starting to turn; we see it in advertising because advertising is incredibly economically tied,” he says. (Interest may be up, but a comparison of the last six issues of 2008 with those of 2009 shows the latter contain one-third fewer ads and 20 percent fewer pages. Maich disagrees with these numbers, but says, “We’re feeling much better about 2010.”) His zeal is also magnified by two sampling campaigns (the distribution of free issues with subscription cards) that he says “did really, really well compared to how those campaigns have done historically.” That might be true, but recent ABC numbers have yet to show an overall increase in subscriptions: for the first six months of 2009, they averaged just under 70,000; for July to December, the figure was 61,500.

I ask Maich what guides him now that the retooled CB is starting to find its footing. His focal point is ensuring his audience is adequately served. “The good thing is that our readers don’t really expect us to predict the future for them. What they want is the best information they can get to frame and to inform their opinions,” he says. “Our readers want it to be entertaining; they demand it be useful.” There is no doubt Maich refreshed a stale magazine—but something he said moments earlier still gnaws at me: “The good thing is that our readers don’t really expect us to predict the future for them.”

Or so he believes. It’s a view at odds with that of David Carr, New York Times business media columnist. “It’s not just business that has changed, it is the idea of business,” he wrote last November. “Writers and editors who cover business now know that the jig is up,” that they can no longer get by on the old “brand promise that suggests that if you clip the right articles, internalize the right rhetoric, then you too will end up as one of the shiny, happy people striding boldly across the pages of magazines.”

Perhaps Maich needs to ask himself: if Canada were hit today with the same severity as the U.S. was, how would he and Canadian Business fare under the same scrutiny directed at American business editors and their publications?

by Jordan Hay

Jordan Hay was the Front of Book Editor for the Summer 2010 issue of the Ryerson Review of Journalism.